From instant clarity to comprehensive planning, we deliver solutions for every stage of our clients' financial journey.

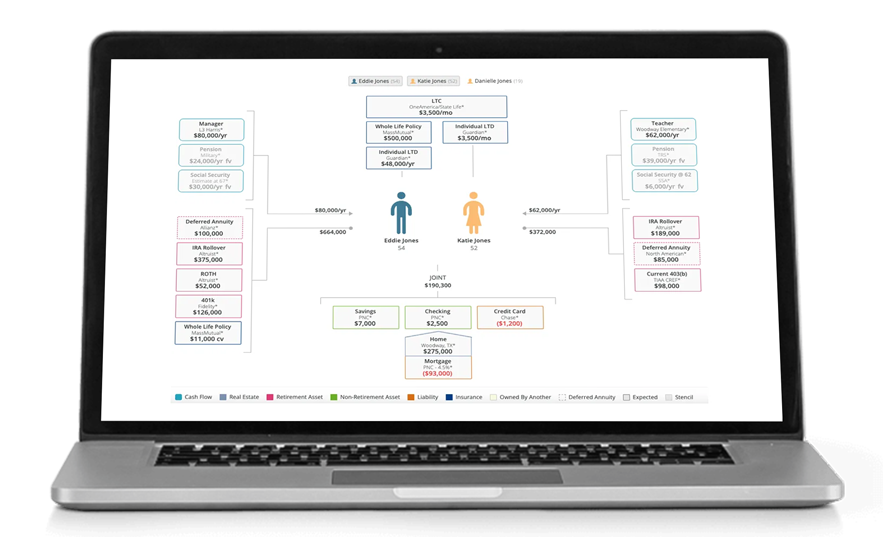

1. Acanto's Asset-Map® Discovery Session

We don’t just “organize” your finances into a single, complete view. Together, we build your family’s Asset-Map® as a crucial starting point to identify blind spots and gaps across your current financial situation. This confidential and complimentary diagnostic exercise provides the clarity needed to design strategies intended to help protect your family and achieve your financial goals.

The Asset-Map® typically takes about 30 minutes to complete securely online and is followed by an approximately one-hour video review session to discuss findings and potential next steps, when appropriate.

- See Where You Are: A clear, single-page view of your entire financial reality.

- Find the Gaps: Instantly spot missing protections, tax inefficiencies, and diversification gaps.

- Build the Structure: The foundation for a plan that goes beyond standard 60/40 allocation.

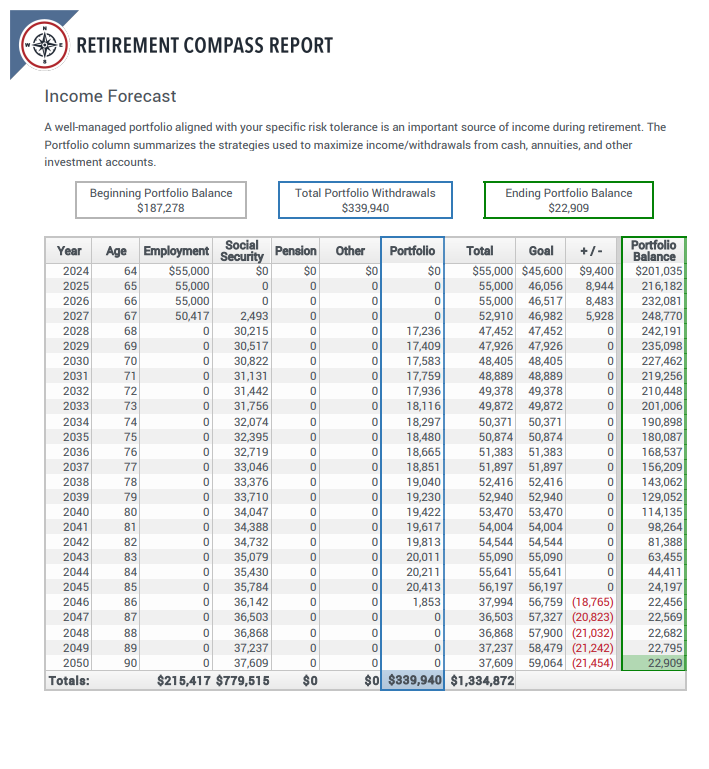

2. Comprehensive Retirement Analysis

For all new clients, we deliver a comprehensive retirement analysis package developed in conjunction with trusted CFP® professionals. We dig deeper into your current financial situation, providing complete financial clarity with a set of personalized, easy-to-read reports, stored in a secure online "Digital Vault" alongside any other critical documents you wish to upload, such as Wills, Trusts, and Estate documents. Utilizing your existing financial, tax, and PIA (Social Security benefit), we create a package that includes:

- Financial Overview

- Roth Conversion “Found Money” Analysis

- Color of Money Risk and Tax Analysis

- Secure Digital Vault for Key Documents

- Social Security Maximization Report

- Portfolio Review

- Asset Allocation Roadmap

- Comprehensive Retirement Report

- Sequence of Returns Risk Analysis

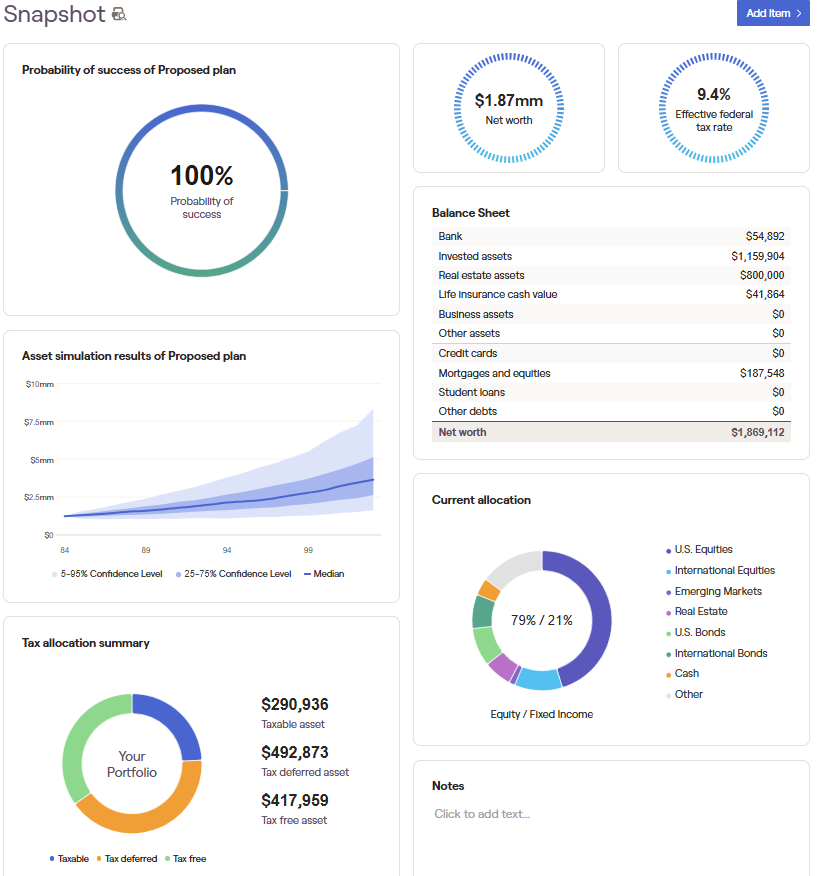

3. Fully Adaptive Financial Planning

For those who want the ultimate in Financial Clarity, we build a living, breathing financial plan using RightCapital's™ powerful software. Whether you need to model a stock vesting plan, RMDs, insurance cash values, real estate income, legacy optimization, or simply want to stress-test your financial future, this portal adapts as your life evolves. You can create detailed expenses, adjust return assumptions, completely optimize your financial future, and securely store critical documents, all in one place.

- Quarterly Reviews & Monitoring

- Estate Planning

- Insurance and Annuity Modeling

- Real Estate Income

- Tax Optimization

- Stock Option Vesting Projections

- Budgeting and Spending Analysis

- Lifetime Cash Flows Analysis

- Secure Online Vault for Critical Documents

- 24/7 Client Access to Model Changes and Edit Assumptions

- Linked Accounts Update Automatically

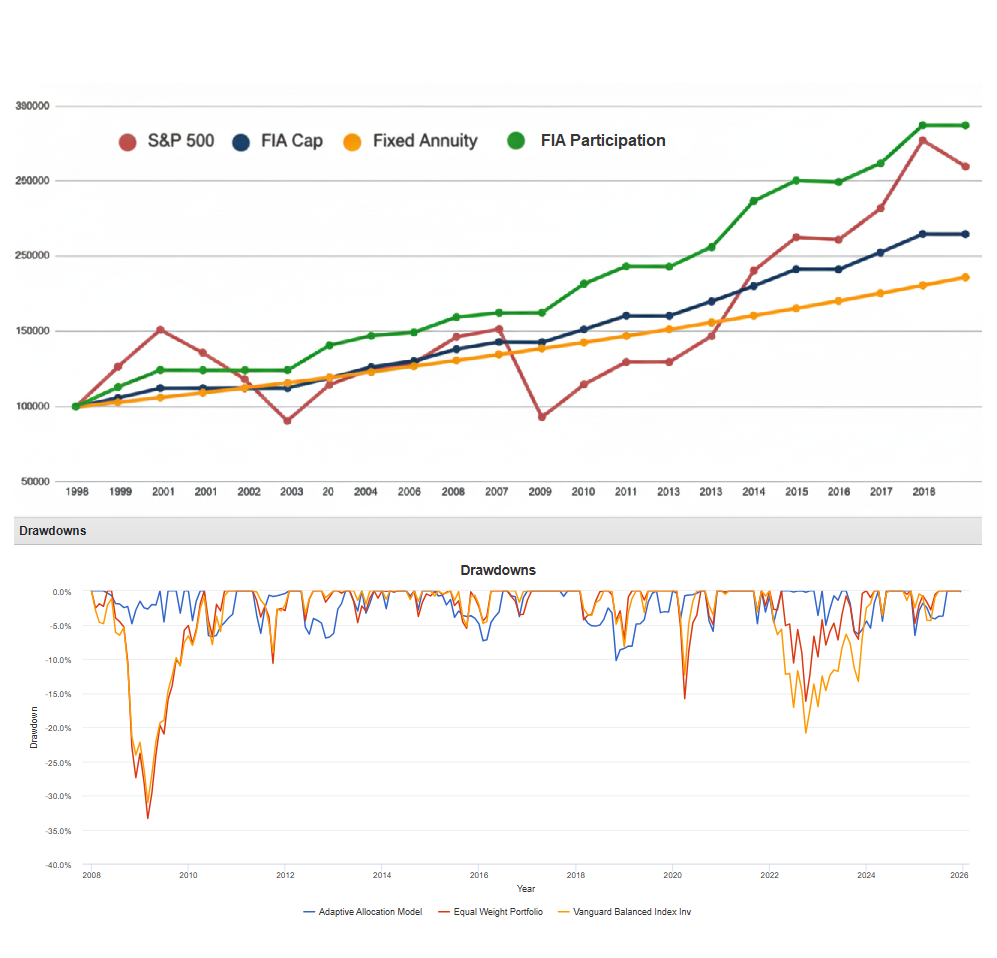

4. Downside Protection & Risk Management*

In a world of AI and rapid economic change, "buy and hold" isn't enough. We use modern tools to try to limit and reduce downside risk* and protect your retirement from emotional and financial damage.

We utilize a combination of strategies, including:

- Tactical Asset Allocation

- Buffered ETFs and Structured Notes

- Fixed Index Annuities with Income Riders

- Alternative Investments (Private Credit, Real Estate)

*Investing involves risk, including the potential loss of principal. No strategy can guarantee a profit or protect against loss in periods of declining values.