Clarity First, Strategy Second, Integrity Always.Many retirement plans rely too heavily on IRA and 401(k) accounts that expose investors to market crashes, forced taxes, or lost decades—risks that ruined countless retirements when the "Tech Bubble" burst in 2000. Acanto LLC starts with your personalized Asset-Map® and a complimentary review. We then produce a full retirement analysis to see how vulnerable you are to a life-changing event—from the loss of a family member to a 2008-style market crash.

Acanto LLC provides Clarity, Strategy, and Integrity to achieve our clients' financial goals. 2022 exposed how "Balanced Accounts" and "Target Funds" failed to protect investors as bonds suffered their worst losses in over 150 years. We use a more Modern Investment Toolkit—from customized insurance products to tax-efficient ETFs and liquid alternative strategies—to craft a strategy that helps secure your "6 Ls" of: Liquidity • Long-Term Disability • Life Insurance • Long-Term Care • Longevity • Legacy

Your Roadmap to Complete Financial Clarity

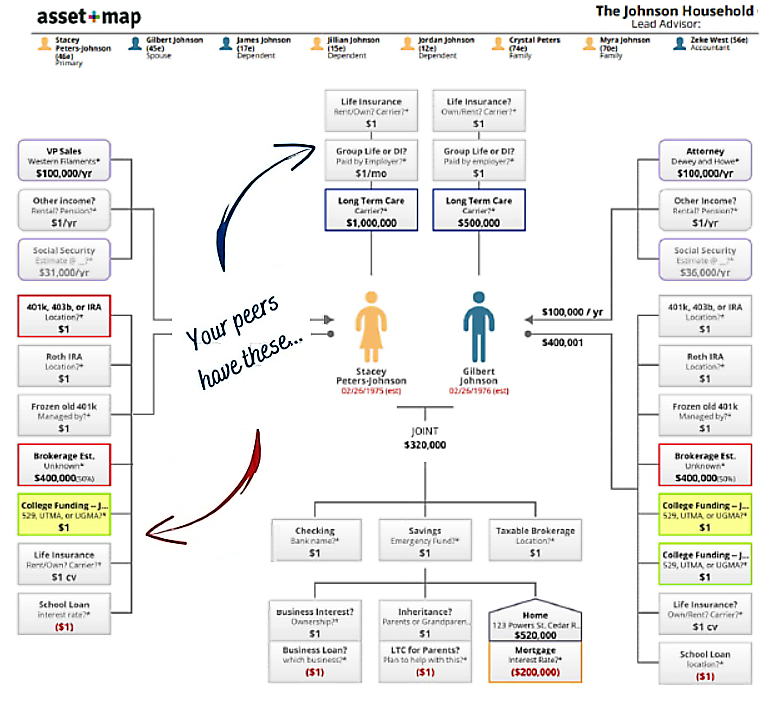

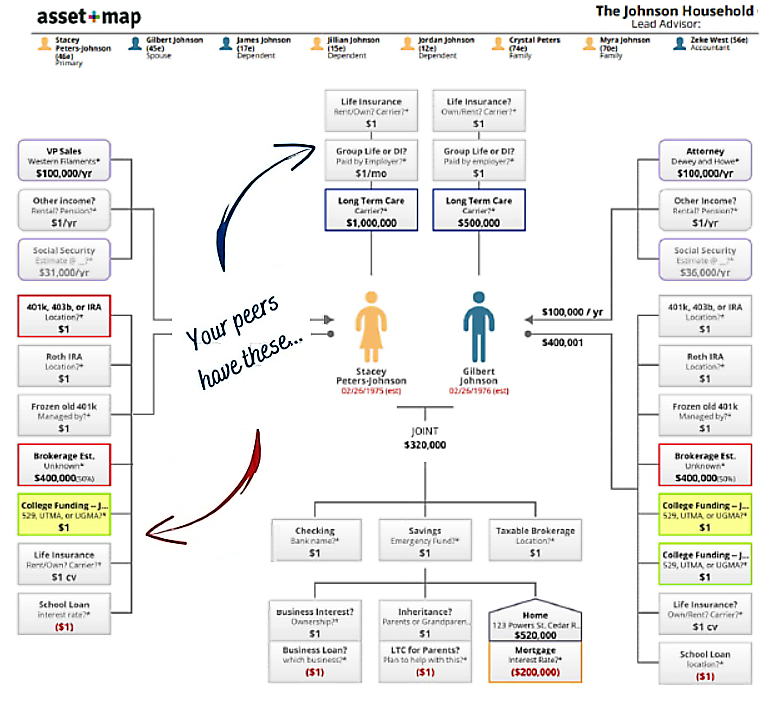

Asset-Map® Discovery

Gain clarity and peace of mind with a confidential Asset-Map® review. Visualize your family’s full financial picture and identify gaps in reaching your goals—securely online.

- Holistic View

- Identify Gaps

- No Obligation

Retirement Analysis

Get a full retirement deep dive and online "Vault" to store critical files. Trusted CFP® and Tax professionals work with us to craft a complete retirement analysis package for you and your family.

- Cash Flow Report

- Tax Analysis

- Digital Vault

Wealth Strategies

Our online portal provides real-time financial clarity in one secure location. Quarterly reviews, budgeting, and modeling tools help our clients align investment strategy with their family’s long-term goals.

- Retirement Modeling

- Estate Strategy

- Ongoing Monitoring

Clarity First:

Most financial planning is overwhelming.

Too many documents, too much jargon, and no clear picture of where you actually stand. It's easy to feel lost. Your first step is a secure Asset-Map® to clarify your entire financial picture.

The Solution: Acanto LLC + Technology

All of our solutions provide Complete Financial Clarity, in one secure location, according to each client's unique needs. The process begins with a complimentary Asset-Map®—a clear, visual overview of your finances.

Fiduciary Standard

As an independent firm, we are legally bound to act in your best interest. We don't push proprietary products; we build strategies that fit your unique life and goals.

Strategy Second:

"Riding it out" is not a strategy... It's a risk.

Markets are uncertain, correlations change, and traditional diversification may not protect against another lost decade. While avoiding every correction is unrealistic, managing long-term downside risk is essential. That’s why we focus on adaptive strategies designed to respond to change—not rely on hope.

Our Toolkit for the New Economy

- Adaptive & Alternative Investment Strategies

- Roth Conversions & Tax-Advantaged Accounts

- Whole, Term & Universal Life Insurance Strategies

- Modern Indexed Annuities & Hybrid Pensions

- Asset Protection & Tax Optimization Strategies

Not ready to start an Asset-Map®?

Download our handy PDF checklist and organization guide to Creating a Financially Organized Life!

Download the guide and book a free 30-minute call with us to see how we can help you optimize your family's financial future.

Book a Call