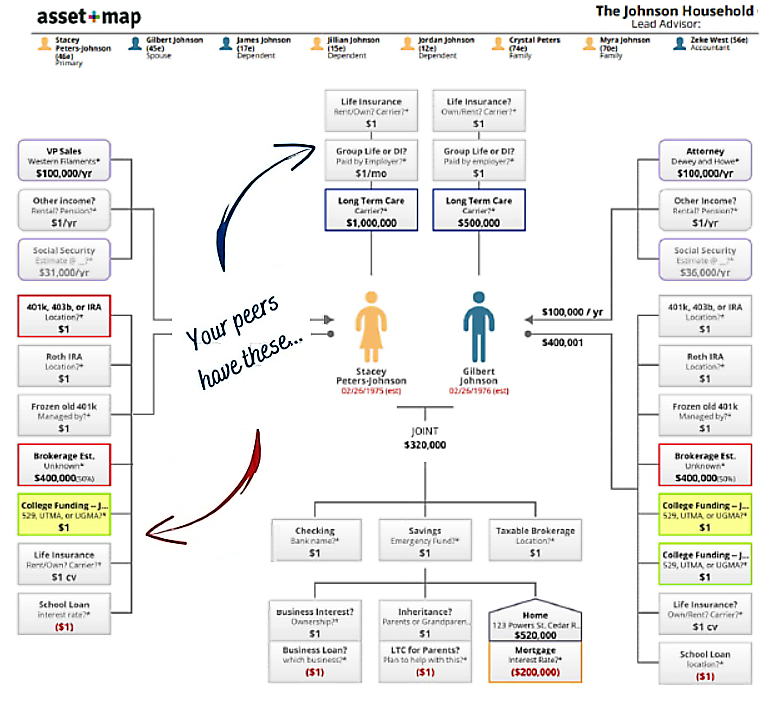

Acanto's Asset-Map® Experience

A visual catalyst for better financial conversations, all on one page.

A single page showing everything you own and owe.

Why Start with an Asset-Map®?

Most financial planning is overwhelming—too many documents, too much jargon, and no clear picture of where you actually stand. Asset-Map® changes that. It consolidates all your financial instruments—investments, insurance, banking, and liabilities—into a single, intuitive visual.

Instant Clarity

See your entire financial life on one page. No more digging through statements to understand what you own.

Identify Gaps Instantly

Visually spot missing pieces in your financial puzzle—like underinsured risks, idle cash, or lack of diversification—before they become problems.

Collaborative Planning

A shared view that puts you and your advisor on the same page—literally. It empowers you to make better decisions by seeing the "big picture" first.

The 6 L's: What We Look For

We use the Asset-Map® to run a "Financial Fire Drill," ensuring you are prepared for the six critical events that impact every financial plan.

L - Liquidity

Do you have enough accessible cash for emergencies and opportunities?

L - Long-Term Disability

Is your income protected if you can't work due to illness or injury?

L - Life Insurance

Is your family's future secure if something happens to you? Plus, leverage cash value for tax-free retirement income.

L - Long-Term Care

Do you have a plan for potential healthcare costs in retirement?

L - Longevity

Will your assets last as long as you do? Are you prepared for a long life?

L - Legacy

Are your estate documents in order to pass wealth efficiently?